NewOptometrist.ca puts the spotlight on Zero to Five Pathfinders

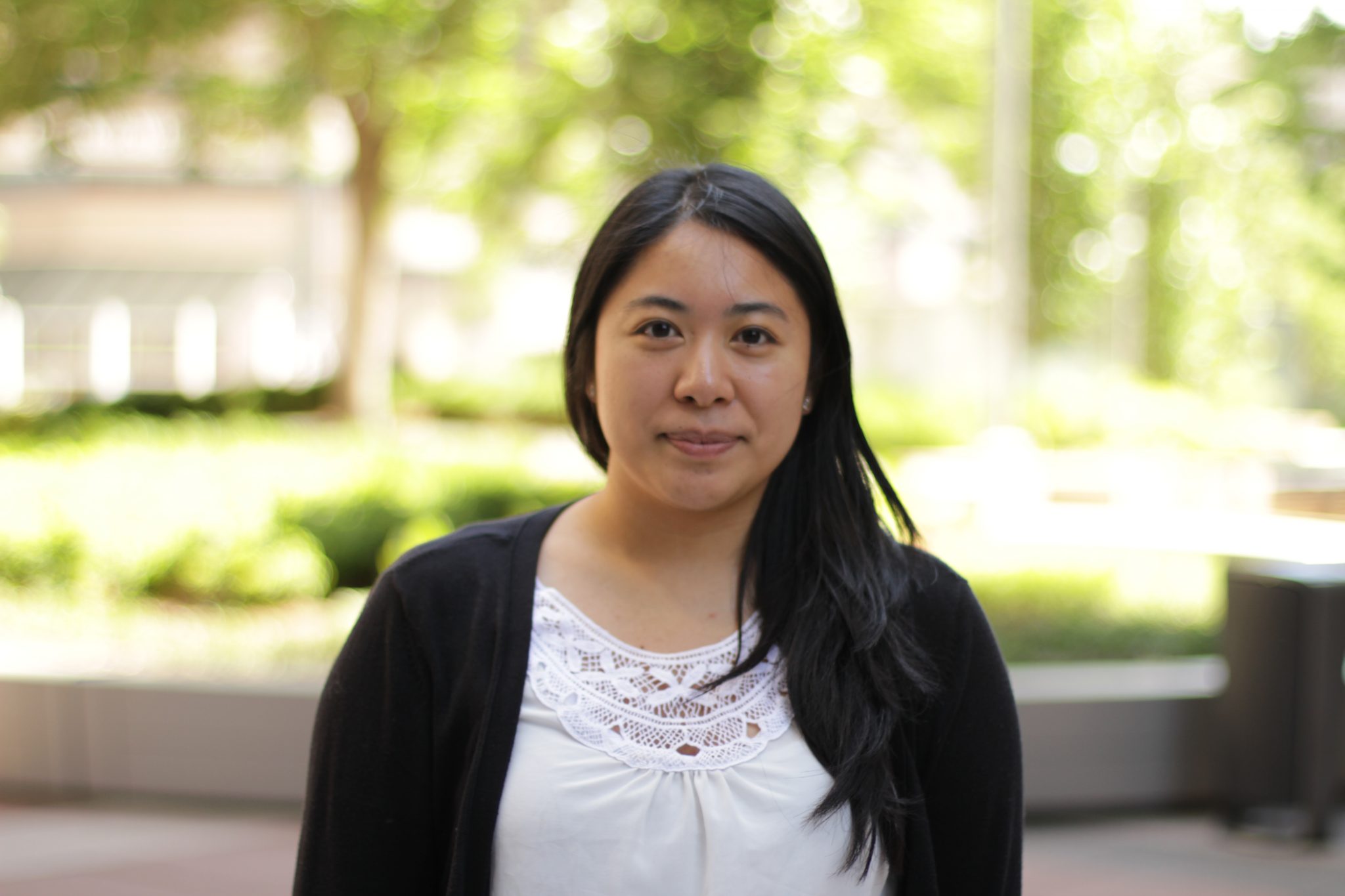

PathFinder Spotlight:

Four Eyes Optometry Podcast

Founders

- Dr. Alex Coon, Wasilla, Alaska, US

- Dr. Amrit Bilkhu, Brampton, Ontario

- Dr. Deepon Kar, Lethbridge, Alberta

- Dr. Ravinder Randhawa, Vaughn, Ontario

Four enterprising female ODs from the Illinois College of Optometry class of 2019 started the “Four Eyes Optometry” podcast, combining their talents and cross-border interests to educate, enlighten and entertain ODs on both sides of the border.

The Four Eyes Optometry founders:

- Dr. Alex Coon, Wasilla, Alaska, US

- Dr. Amrit Bilkhu, Brampton, Ontario

- Dr. Deepon Kar, Lethbridge, Alberta

- Dr. Ravinder Randhawa, Vaughn, Ontario

… combined their answers to questions posed by NewOptometrist.ca Editor Dr. Jaclyn Chang.

After reading their responses below, make sure you sign up to their podcasts. You can view the entire list of podcasts from Four Eyes Optometry here: See the list (the ladies have been busy!)

Jaclyn: Are there any resources that you can provide for new graduates that you found helpful?

Four Eyes Optometry: Besides the Four Eyes Optometry podcast, we all found that joining our provincial and state associations tremendously helped with information about licensing, job searches, and the overall process of transitioning from a student to an independent optometrist.

Other valuable resources we all use on a regular basis to keep up to date with what is occurring in the eyecare industry are various digital publications such as, Eyes on Eyecare, Modern Optometry, Review of Optometry, and 20/20 Glance.

Jaclyn: Can you provide job search/interview/contract advice?

Four Eyes Optometry: Since all of us have been working full time in various practice modalities for the last couple of years, our most important piece of advice is to not always accept the job that pays the most.

You may be offered a position where the compensation is great, but you are questioning yourself about the hours, equipment available, staff, and the number of patients that need to be seen.

These feelings of uncertainty will not eventually disappear as you practice, they will often return until you decide to address them.

Money will seem like the priority when you first graduate because of those pesky student loans that need to be paid off, but from our experiences, money is definitely not everything when it comes to avoiding burnout and finding an appropriate work-life balance.

Jaclyn: Describe your first day of work.

Four Eyes Optometry: We have all talked about similar anxious experiences from our first day of practicing as an independent optometrist. Most of us were working as solo practitioners and were very aware that we did not have an extra set of eyes to help with diagnosis, treatment and management if we were ever unsure of the clinical situation.

The first day, and even the first week, was very nerve wracking for all of us, especially since there is no Attending to double check your work and guide your clinical decisions. Even during those initial anxious moments practicing on our own, we would constantly text each other in our group chat hoping one of us would have the correct answer, and what we all eventually came to realize is that it is absolutely okay if you do not have the immediate answers, you can always follow up with patients at a later time and systematically plan your approach to their care.

Jaclyn: What advice would you give a new grad today?

Four Eyes Optometry: If you or a group of your friends have been thinking about creating something, starting a project, or reinventing a product that is already out there, whether or not it has to do with the eye care industry or not, without a doubt, just start it!

The most difficult step is to start, and then the second most difficult step is to be consistent with your efforts towards your creative project.

Even if you do not know all the steps to get to the result you want, you will figure out everything as you trudge along. This is exactly how we started the Four Eyes Optometry podcast. We began not knowing everything that could potentially go wrong, and when they did, which was often, we figured it out together and learned a great deal from the process.

Jaclyn: What is your definition of success or what habits make you a successful person?

Four Eyes Optometry: In our opinion, any person with a goal in which they are consistently putting in those tough and long hours towards achieving it every single day, is already a successful person.

It really is all about the process. Being able to look back on those rough experiences and hard lessons during the journey will always make reaching the destination so much more rewarding.

Jaclyn: What is your most effective marketing tool/platform?

Four Eyes Optometry: “Do it for the gram!” All jokes aside, Instagram has been our podcast’s platform of choice because of the multitude of opportunities to network with so many of the amazing and different eye care professionals we have connected with in the past and plan to connect with in the future.

Jaclyn: What was the last time you laughed?

Four Eyes Optometry: We always have belly aching laughs when we are together recording our weekly podcast episodes; we definitely do not take ourselves too seriously. Our regular Happy Hour podcast episodes definitely show off our goofy personalities!

Jaclyn: What is your favorite TV show / Netflix series?

Four Eyes Optometry: All of us have lived with one another at different points of time during our optometry school days. The TV genre that always excitingly brought us together in the living room, along with various snacks in hand, was tacky reality TV. These TV shows included everything from Netflix’s bakeoff challenges to MTV’s Floribama Shore. Quite a range, we are aware. Even though we do not have much time to watch these entertaining TV series now, we once did schedule time to live vicariously through these so-called TV characters on a regular basis, and shamelessly loved every moment of it!