I often hear that Guaranteed Investment Certificates (GICs) are risk free because they protect your capital, much like a savings account would be considered risk free. Although this makes sense on the surface, these “safe” investments are anything but.

What is Risk?

Risk refers to the degree of uncertainty of achieving an expected rate of return. Thus, if all factors are equal, the degree of risk (uncertainty) and the expected rate of return should correlate accordingly. Ideally, more uncertainty, more expected return.

Impact of Inflation

One risk with all investments, including GICs is a long-term inability to keep pace with inflation. Essentially, the cost of living continues to increase and if your money isn’t keeping pace, your purchasing power decreases. A million dollars in 1988 (when the Bare-Naked Ladies would purchase a house, a K-Car, and really expensive ketchup) bought you a lot more than a million dollars will buy you today. A loaf of bread at the time was under $1 while the current average for boring bagged bread is around $3.

But Doesn’t a GIC Pay More Than Inflation?

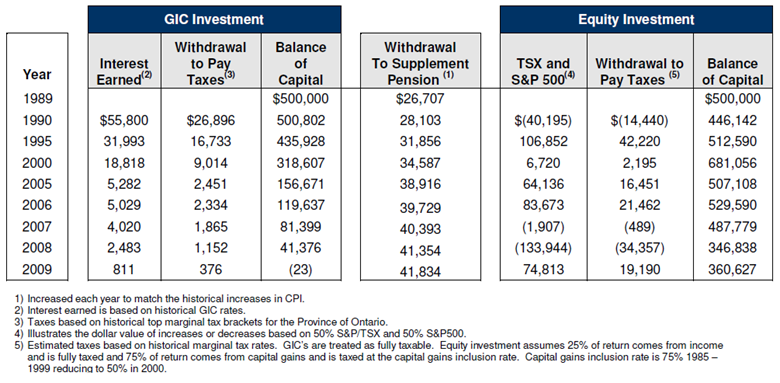

Let’s look at an example based on known history. If you retired in 1989 with $500,000 in non-registered capital invested in a GIC and withdrew a net of $26,707 from this savings for annual spending, adjusted for inflation and taxation on the investment earnings, you would have run out of money in 20 years.(1) And keep in mind that GICs paid much better in the ‘90s at upwards to 7.1% for a 5 year GIC when inflation was 1.7% (2).

What are my Options?

Because no investment is risk free, and because hindsight is 20/20, we can use the same 20 year period invested in the TSX and S&P 500 indexes, with their fluctuating market valuation, and after 20 years you still had $360,627 left.(1)

I’m not saying you should invest in these markets specifically, especially during a withdrawal phase, but you should be aware that there are other options that can do a better job long term to keep up with inflation.

Other Components of Risk

Inflation and taxation both play integral roles in understanding your true rate of return and purchasing power for all investments, but you shouldn’t negate other factors of risk to define what is ultimately suitable for you, your goals and long-term needs.

Throughout history, variability in markets is really a short-term risk, just pull up an image of an Andex® chart to see the historical long-term growth of various investments.

Other factors to consider include currency risks, geographic and political risks, liquidity (ability to get usable cash when you want it) risks and timing of withdrawals (having to cash out an investment when markets are down create a permanent loss that can’t be recovered from).

The Bottom Line

The truth is what is often considered “risk free” is really just “comfortable”. It provides uneducated investors with a false sense of security based on knowing that their capital isn’t subject to stock market sentiment of day. Understanding that no investment is truly risk free will allow you to make more suitable investment decisions based on your comfort level as a well-educated investor.

- calculations provided by PlanPlus Planit

- 1995 values as reported https://www.ratehub.ca/blog/the-history-of-gic-rates/

Advisory

Have more questions? As your Chief Financial Officer, I am here to help you make smart financial decisions that align with your business growth, personal wealth creation strategy and long-term interests. Helping you understand your money and assisting you in making informed decisions about your investment options are just some of the ways that I work as your fiduciary.

Educating you is just one piece of being your personal CFO that we excel at. Call (780-261-3098) or email (Roxanne@C3wealthadvisors.ca) today to set up your next conversation with us.

Roxanne Arnal is a former Optometrist, Professional Corporation President, and practice owner. Today she is on a mission to Empower You & Your Wealth with Clarity, Confidence & Control.

These articles are for information purposes only and are not a replacement for personal financial planning. Everyone’s circumstances and needs are different. Errors and Omissions exempt.

ROXANNE ARNAL,

Optometrist and Certified Financial Planner

Roxanne Arnal graduated from UW School of Optometry in 1995 and is a past-president of the Alberta Association of Optometrists (AAO) and the Canadian Association of Optometry Students (CAOS). She subsequently built a thriving optometric practice in rural Alberta.

Roxanne took the decision in 2012 to leave optometry and become a financial planning professional. She now focuses on providing services to Optometrists with a plan to parlay her unique expertise to help optometric practices and their families across the country meet their goals through astute financial planning and decision making.

Roxanne splits EWO podcast hosting duties with Dr. Glen Chiasson.