One of the more fascinating parts of having a Data Analytics system and tracking metrics are the trends that we see both within an office and sometimes across many offices. Our job, as we analyze these trends and data, is to try to determine WHY we are seeing a certain trend in the numbers we analyze. Our experience in the office or in the industry in general, will lead us to make certain hypotheses about what we are seeing.

The next step is to either prove or disprove our theory. To do that, we may need to track some activities manually. While we always prefer to collect and use digital data, sometimes the answers we are seeking aren’t captured in the software.

For instance, we recently detected a declining capture rate in one of the office’s we work with. The trend was specific to the associate and not the owner, who continued to see a steady or improving capture rate. We speculated about what could cause this trend that had persisted over two quarters. Were the dispensers not paying as much attention? Were the patients seeing the associate different from the patients that see the owner? Were some of the solutions offered to the patients more effective than others?

When we spoke to the owner and associate, it wasn’t a trend they had been aware of prior to our conversation. They began the same process of speculating about what could be causing it. It certainly lead to a productive conversation about how the associate was finding it difficult to find someone to hand off to – a problem that the owner wasn’t experiencing. Otherwise, they couldn’t pin point what the exact cause might be.

We decided to go through the exercise of tracking for a month to see what the root cause was. We made a simple chart with the following headings:

- Px Name

- Glasses Solutions offered by Doc

- Solutions purchased

- Reasons for NOT purchasing

- Who doc handed off to

We then tasked the associate with making sure the chart was filled out every day. Part of the process was seeking out the Optical Manager to determine who purchased, who didn’t and why.

This exercise was productive for two reasons; one, it gave the associate an opportunity to connect on a regular basis with the optical manager. It also lead to some insights into what resulted in a higher capture rate.

After tracking this information, we came up with two action items.

The first was to assign a dispenser to each doctor every day. This way, there was no question when the associate came out who should be stepping up to catch the patient.

The second was the need to do an inventory analysis. While the patients who were seeing the owner were finding frames that suited them, the associate’s patients seemed less likely to find their perfect pair.

We are now going to dig a little deeper and analyze what the objections and how we can close the gaps.

Tracking data can show us trends we may not even be aware of. While we may have hunches as to why the trend is occurring, it is a worthwhile exercise to put your hunches to the test. Not only will you have a better idea of how to close the gap but you don’t know what other benefits you may also discover.

KELLY HRYCUSKO

is the co-founder and managing partner of Simple Innovative Management Ideas (SIMI) Inc. and expert Practice Management contributor for Optik magazine. She can be reached at info@simiinc.com.

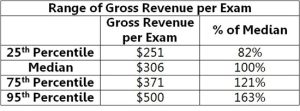

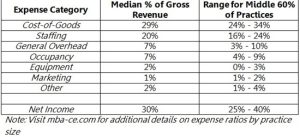

The first thing you need to do in order to determine your chair cost is to calculate your fixed costs. You can calculate your fixed costs by subtracting your operating expenses, your doctor payroll, and your net, from your gross income. From there, you will divide your fixed costs by the number of complete annual exams, or annual patient visits, to get your chair cost.

The first thing you need to do in order to determine your chair cost is to calculate your fixed costs. You can calculate your fixed costs by subtracting your operating expenses, your doctor payroll, and your net, from your gross income. From there, you will divide your fixed costs by the number of complete annual exams, or annual patient visits, to get your chair cost.

OALS

OALS