Dr. Roxanne Arnal, CFP®

It’s that time of year where we are trying to get everything done – to close out the year before we head into next year with a fresh start.

For the past year, I have had several goals. Some were simple checklist goals, such as reading twelve books. Sounds easy enough, but I haven’t yet achieved it. I have several books that are in the incomplete stage, so there is still time.

Other goals, like forecasting goals, were and weren’t achieved.

And lastly, my dream goals. While they are the hardest to achieve, they are what I had the most success with in 2021.

As a planner, I talk about goals at every juncture. They provide us with the direction we need to build out the plan. Often, I find that the conversation starts with checklist goals, and then we build from there.

Generally, people don’t know, or are unwilling to share, their dream goals without some prodding. But let’s face it, dreams are what get us excited to get out of bed in the morning!

Checklist Goals

Checklist goals are those that you already know how to do. They are merely items with or without a deadline that you believe you either must do or want to do.

Checklist goals are those that you already know how to do. They are merely items with or without a deadline that you believe you either must do or want to do.

Read twelve books in a year. Paint the house. Host Christmas dinner for the family.

These are generally simple “what” goals. What do I want and/or need to do? Boring, but nonetheless, necessary in order for us to advance.

Forecast Goals

These are goals that you think you can do. These are typically based on past performance and outline projections for the New Year.

Most of us are very familiar with forecasting in our businesses. Based on what we accomplished this year, we expect to accomplish 10% more next year. That kind of thing.

In financial planning, we often use forecasting to plan out your retirement needs. Based on how much money you spend on your lifestyle today, we can forecast what your need will be in 20 or 30 years for example.

In financial planning, we often use forecasting to plan out your retirement needs. Based on how much money you spend on your lifestyle today, we can forecast what your need will be in 20 or 30 years for example.

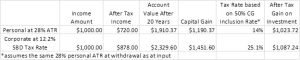

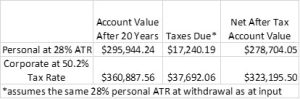

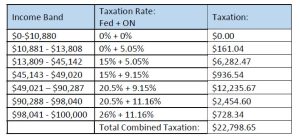

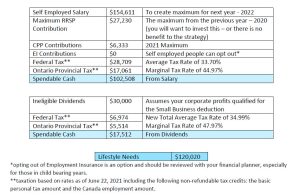

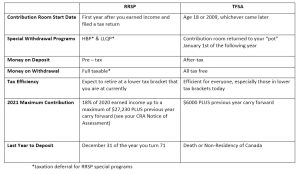

We make assumptions based on inflation and the rate of return of your investments. We add checklist goals for your contributions to your RRSP and TFSA for example. Then, when you meet with us for follow-ups, we make the necessary adjustments and continue ahead.

Forecasting goals provide us with direction and instructions as to how to proceed. So I often refer to these as “how” goals.

Dream Goals

Do you remember being a young child and dreaming that someday you’d be a firefighter? A teacher? An Olympic ice skater? An astronaut, An Optometrist?

Well maybe not about being an Optometrist, but here you are!

These dreams got you out of bed in the morning and into a classroom to absorb all the knowledge you could. They had you climbing ladders outside your house. They had you training at the gym and spending 20 hours a week at the ice rink.

For some of us, the dreams were vivid and real and pushed us to succeed. For others, they were merely passing by, and we updated them regularly as our interests changed.

At their heart, dream goals cause us to grow. They cause us to seek out new experiences and push us to achieve something more. Dream goals motivate us to get out of bed and charge forward into our day with excitement.

At their heart, dream goals cause us to grow. They cause us to seek out new experiences and push us to achieve something more. Dream goals motivate us to get out of bed and charge forward into our day with excitement.

Then life happens. For many of us, we forget how to dream because we are caught in what we thought we are supposed to be doing. We get busy with running through the motions of being a parent, a business owner, a spouse. And we forget to dream.

It’s not that any of these accomplishments are bad. These are all wonderful things, but we often end up getting stuck and don’t grow. Why?

Connecting with Your Why?

That’s exactly it. We forget our WHY. At the core, dream goals are our why. I’m sure you’ve heard it before. Start with WHY.

We need to take the time to find some silence, to shut off the devices and just be in the moment with ourselves and reconnect to our WHY. Why did you want to be a parent? Why do you want to own your business?

I often must prod my clients in the first couple of meetings to uncover their why. To understand what is truly important to them and what they would love to achieve if only given the opportunity.

This is why. Why I do what I do. Why it’s important. It’s about Your WHY.

Prepare for the New Year

I encourage you to take some time this holiday season to connect with yourself. To figure out your why.

When we become present, we are often surprised at what we learn about ourselves. When we reconnect to our why, we often find out we are a lot happier than the motions would indicate. When we define our why, we can create some amazing dream goals.

Set all three types of goals for the New Year. Then give me a call or an email and share them with me. When we share those goals with someone else, we create accountability. And when we create accountability, we increase our chances for success.

My dream goal doesn’t change often. I dream to write my own book and get it published. In 2021, I completed the first draft and shared it with someone who has agreed to co-author with me. It might not have gotten published yet, but we are moving in that direction. It pushes me to grow. To be vulnerable and keeps me connected to my why.

In 2020, I wrote my dream goal as it pertains to my business. I made leaps and bounds in that area in 2021 and continue to build out avenues that open more doors. I didn’t know the how when I wrote this goal, but I continue to remain focused and somehow, the how seems to be unfolding around me.

As one year rolls into the next, I wish you a list of goals. Some that you will check off to show discipline and progress. And then some big, audacious goals that will force you to grow.

When you grow, you live.

I wish you all a year ahead of good health, much laughter, and tremendous growth.

As your Chief Financial Officer, I’m here to help you identify your goals, set your plan in place, monitor and adjust it as the wind changes. I help you manage a team of financial professionals and ensure that you have thought about the potential issues and opportunities.

Have more questions than answers? Educating you is just one piece of being your personal CFO that I offer. Call (780-261-3098) or email (Roxanne@cfspsc.ca) today to start your plan.

Roxanne Arnal is a former Optometrist, Professional Corporation President, and practice owner. Today she is on a mission to Empower your Finances.

These articles are for information purposes only and are not a replacement for personal financial planning. Everyone’s circumstances and needs are different. Errors and Omissions exempt.

ROXANNE ARNAL,

Optometrist and Certified Financial Planner

Roxanne Arnal graduated from UW School of Optometry in 1995 and is a past-president of the Alberta Association of Optometrists (AAO) and the Canadian Association of Optometry Students (CAOS). She subsequently built a thriving optometric practice in rural Alberta.

Roxanne took the decision in 2012 to leave optometry and become a financial planning professional. She now focuses on providing services to Optometrists with a plan to parlay her unique expertise to help optometric practices and their families across the country meet their goals through astute financial planning and decision making.

Roxanne splits EWO podcast hosting duties with Dr. Glen Chiasson.