Roxanne Arnal, Optometrist and Certified Financial Planner© has made her article available in audio format.

Click the play button below to listen.

Dr. Roxanne Arnal, CFP®

The Canadian Tax system is one of the most complicated in the world, so it’s no surprise that several tax terms used may feel unfamiliar and confusing to you.

We’ll start with some of the basics of personal taxation, more specifically tax rates. Personal tax rates in Canada are banded which means you will pay a different percentage of tax on different amounts of your income dollars. Let’s break it down –

Federal Marginal Tax Rates (Federal MTR)

At the time of writing, the federal tax rate on your first $49,020 of taxable income is 15% which means for every $1 of income you earn, you pay 15 cents in federal tax (excluding deductions but we’ll get there!). Band two (income between $49,021-$98,040) increases to 20.5% tax rate which means you will pay an extra 5.5 cents per dollar earned in tax! At the highest level of federal tax every dollar amount earned over $216,512 is taxed at 33%.

Provincial Marginal Tax Rate (Provincial MTR)

This works much the same as the federal MTR, but many provinces and territories in Canada use different income cut offs. For example, if you earned $100,000 depending on your province this would place you in the 11.16% MTR for Ontario, the 10.00% MTR for Alberta, and a whopping 17.5% MRT for Nova Scotia. Curious based on your existing income level? Here’s a super handy chart (LINK MACKENZIE Form)

Combined Marginal Tax Rate (Combined MTR)

Based on the above example, if you earn $100,000 while living in Ontario, your combined marginal tax rate would be 37.16%.

Average Tax Rate (ATR)

This describes the overall average amount of tax you pay. Because of banding and in recognition that higher dollars are subject to higher amounts of taxation, your average tax rate will be less than your MTR. What’s your ATR on $100,000 of earned income? Hold tight, we’re getting there.

Deductions

To make this just a little more confusing, there is also a myriad of tax credits and deductions. These too can be very different federally, and by each province. The basic personal exemption that applies to nearly every tax paying Canadian, for 2021, means you won’t pay any federal tax on the first $13,808 you earn and you won’t pay Ontario provincial tax on the first $10,880. But remember, I said “nearly”. There are exceptions to most of the rules. Federally, the basic personal exemption is subject to a gradual reduction for those earning over $151,978, until it reaches only $12,421 at an income level of $216,511. And then there are different rules provincially. See what I mean by complicated!

An Ontario Example

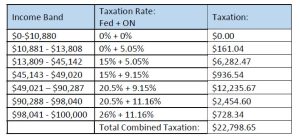

For illustrative purposes, we are going to assume you earn $100,000 of employment income in Ontario. This table illustrates the actual tax rates from both the federal and Ontario Governments and total tax dollars that apply to each band.

At $100,000 of income, your combined MTR is 37.16% while your average tax rate is 22.8%, or $22,798/$100,000.

A Few Other Notes

There are a large number of federal and provincial tax credits and personal deductions that may apply to you and I encourage you to become at least somewhat familiar with them. Some of the more common ones include: childcare expenses, RRSP deductions, disability tax credits, professional dues deductions, moving expenses, charitable donations, the list goes on and on. You can find these easily on government websites and are not included in our above example.

Why Does it Matter

Knowing your MTR is key to understanding how best to strategize your investments (for example your TFSA, RRSP and non-registered savings contributions), amongst other financial planning components to help support your overall wealth creation and minimize taxation. MTR is used to describe how much income tax you are going to pay on your next dollar of taxable income.

Understanding your ATR will help you plan your cash flow. As per the above example, after income taxes, you have $77,201.35 to spend on your debt repayment, housing, savings, expenses and entertainment.

Have more questions than answers? Educating you is just one piece of being your personal CFO that I offer. Call or email today to start your plan.

These articles are for information purposes only and are not a replacement for personal financial planning. Everyone’s circumstances and needs are different. The values provided here are subject to change and should not be construed as fact. Errors and Omissions exempt.

Federal Link: All deductions, credits, and expenses – Personal income tax – Canada.ca

ROXANNE ARNAL,

Optometrist and Certified Financial Planner

Roxanne Arnal graduated from UW School of Optometry in 1995 and is a past-president of the Alberta Association of Optometrists (AAO) and the Canadian Association of Optometry Students (CAOS). She subsequently built a thriving optometric practice in rural Alberta.

Roxanne took the decision in 2012 to leave optometry and become a financial planning professional. She now focuses on providing services to Optometrists with a plan to parlay her unique expertise to help optometric practices and their families across the country meet their goals through astute financial planning and decision making.

Roxanne splits EWO podcast hosting duties with Dr. Glen Chiasson.