Roxanne Arnal, Optometrist and Certified Financial Planner© has made her article available in audio format.

Click the play button below to listen.

Dr. Roxanne Arnal, CFP®

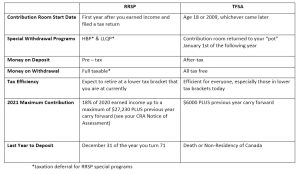

Good question. Let’s start with some general information. What is an RRSP and a TFSA? Both are account types that have been given special tax treatment with the CRA. Both account types, along with open accounts, RESP and RDSP accounts for example, can hold a number of different kinds of investments within them.

RRSP

An RRSP is a Registered Retirement Savings Plan. It was designed to create a personal pension and really came into favor when businesses took a step back from offering those juicy Defined Benefit Pension Plans (DBPP). If you know of anyone who works for the government, chances are they still have a nice DBPP. For the rest of us, it is really our own responsibility to build a retirement nest egg that will allow us to live the lifestyle of our choosing when we no longer want to see patients in the little dark room. (You should also be aware that there are a couple of special withdrawal programs tied to an RRSP, such as the Home Buyers Program (HBP) and the Lifelong Learning Program (LLP). These are topics for another day.)

An RRSP at it’s core is a tax deferral vehicle. It allows you to take some of your income from today, invest it according to the program, and on withdrawal, pay tax at your then current rate. So from a planning perspective, an RRSP works best when you anticipate moving from a current high tax rate to a future lower tax rate.

Of course, there is no way to know what the future tax rates are going to be – so yes, this is a bit of a gamble. But historically, the income tax banding system used in Canada doesn’t change significantly and typically, year over year, they are adjusted for inflation. Planning does require various assumptions, and the future tax regime is one such set of assumptions we use.

TFSA

A TFSA is a Tax Free Savings Account and takes your current after tax money on deposit. In this case however, the investment growth is 100% tax free on withdrawal. Sound enticing? Well it should be! A TFSA works especially well if you are currently in a lower tax bracket and expect to be in a higher tax bracket in the future. And I don’t just mean in retirement.

Contribution Room

Both a TFSA and a RRSP have contribution room maximums that are calculated completely different.

You start to earn TFSA contribution room the year you turn 18 (provided you turned 18 on or after 2009 when the program started). Currently, the annual increase in your contribution room is $6000. Your contribution room continues to grow every year you are alive. When you make contributions, the room for future contributions decreases. When you make a withdrawal, the contribution room is returned to you the following January. This makes TFSA accounts a great place to park money for future large expenses, short and mid term goals. However, their very best use remains for retirement.

The contribution room in a RRSP is based on your annual tax reported income. So if you started filing tax returns at 14, you were already creating a contribution room pool based on 18% of your annual income, up to the annual maximum. Your annual income is defined as regular income and does not include dividend or other investment income. This of course opens up the question for self employed people – do you take salary or dividends? Yup – that’s a topic for another day.

But which one is best?

For most of my clients, we utilize both account types. The split is really dependent on how you create your cash flow, manage your tax strategy and organize your goals.

There are some general tax guidelines, but what you want your money to do for you should always be the most important guiding principle in how you invest. Your goals provide the framework for all the planning work we do together – because at the end of the day, it’s all about you!

If you have any questions, please don’t hesitate to reach out.

ROXANNE ARNAL,

Optometrist and Certified Financial Planner

Roxanne Arnal graduated from UW School of Optometry in 1995 and is a past-president of the Alberta Association of Optometrists (AAO) and the Canadian Association of Optometry Students (CAOS). She subsequently built a thriving optometric practice in rural Alberta.

Roxanne took the decision in 2012 to leave optometry and become a financial planning professional. She now focuses on providing services to Optometrists with a plan to parlay her unique expertise to help optometric practices and their families across the country meet their goals through astute financial planning and decision making.

Roxanne splits EWO podcast hosting duties with Dr. Glen Chiasson.