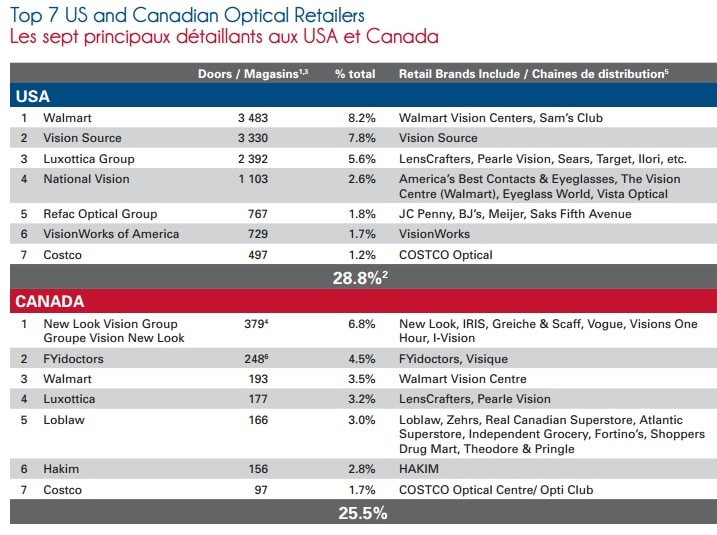

The Top 7 retailers with the largest US footprint, defied by the number of store locations, grew nearly 5% in revenue in 2017, while the number of store locations remained flt (down 0.1%).

Optik compared each country’s largest retailers and found that the level of store concentration in Canada has drawn closer to that of the USA due to the aggressive acquisitions by New Look Vision Group and FYidoctors in particular.

While Private Equity investment has been a significant driver in US market consolidation, the same phenomenon has not impacted the Canadian market so far. In Canada, direct foreign investment from France, UK and Hong Kong, has spawned new foreign entrants including Optical Center, Ollie Quinn and Mujosh, while new entrants from the USA, including Oliver Peoples (Luxottica), Warby Parker and Illesteva are pursuing the upscale fashion-forward opportunity in major Canadian urban markets.

Mass Merchants

Walmart and Costco alone account for 25% of the Top 7 sales and 32% of the dispensing doors. In Canada they collectively account for less than 25% of dispensing doors. While no grocery retailers made the USA Top 50 list, Canadian grocery giant Loblaw ranks fourth in national footprint.

The Top Canadian Retailer Report is coming soon! Optik plans a comprehensive Top Canadian Retailer Report later in 2018, including dispensing doors and revenue. Retailers are invited to download the survey and self-report sales in order to contribute to the Optik Top Canadian Retailer Report.

References/Références :

1 Vision Monday Top 50 Report May 2018

2 US doors are based upon Vision Monday Top 50 report. Total USA dispensing door estimates Jobson Medical Information LLC

3 Canadian estimates by VuePoint IDS Inc based upon publicly available data as of March 2018

4 New Look Vision Group Annual Report 2017

5 May not include all listed retail brands

6 Self-reported by group