Most optometrists that we speak to agree strongly that Metrics are essential for managing their businesses well. However, they all have the same challenge when it comes to implementation—time. Managing a practice in between patients is difficult, if not impossible.

While moving to an automated system to generate Key Performance Metrics can save hours of time each month, it is also crucial to have these metrics reviewed and a plan developed based on the results.

As we have written in past articles, it is essential that the practice owner be involved in this process. However, it can also be effective to bring in an office manager or other trusted employee to help with the management and implementation of goals.

One of the metrics that we follow in SIMI Analytics is the mix of patients. For instance, of all the patients seen, what percentage are children, adults and seniors for each owner and each associate? We also follow how many new patients are seen by each OD. As time goes on, the older the practice, the older the patient base. It is essential that ALL ODs have a growing practice, not only the newer associates.

These are relatively easy metrics for staff to have control over and track the types of patients seen and the appointment codes booked. Many software systems allow the practice to colour code specific appointment times. Using this, the staff can create a colour grid to help them achieve their goal of an ideal mix.

Once they have filled, for example, the new patient spot for one doctor that day, they may choose to schedule the next new patient with another doctor to spread out the new patients. Once the doctor has established what their “perfect day” looks like, the team can colour coordinate the schedule to make that the goal. Of course, there will be exceptions, and a filled schedule is preferred to gaps in the day. On a monthly basis, the staff can review the metrics for that month to see how closely they came to achieving the ideal on an average day.

Another metric that staff can have a lot of control over is diagnostic capture rate. While it is the doctor’s recommendation that often influences the patient’s decision to proceed with additional testing, the staff can ensure that someone is always available to conduct the testing. Again, the staff can see the accumulative results on a monthly basis. Whether tied to a bonus system or simply used for intrinsic motivational purposes, staff owning the results can have a large impact on the performance of a practice.

There are a number of metrics that can be tracked in the optical to encourage staff ownership of the results. Progressives sales, sunglass sales and second pairs are all metrics that should be tracked, and preferably by the staff. When individuals track results, there is more likely to be a desire to have an impact on them.

CHRISTINA FERRARI

is the co-founder and managing partner of Simple Innovative Management Ideas (SIMI) Inc. and expert Practice Management contributor for Optik magazine. She can be reached at info@simiinc.com

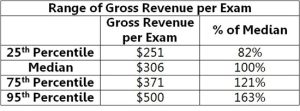

The first thing you need to do in order to determine your chair cost is to calculate your fixed costs. You can calculate your fixed costs by subtracting your operating expenses, your doctor payroll, and your net, from your gross income. From there, you will divide your fixed costs by the number of complete annual exams, or annual patient visits, to get your chair cost.

The first thing you need to do in order to determine your chair cost is to calculate your fixed costs. You can calculate your fixed costs by subtracting your operating expenses, your doctor payroll, and your net, from your gross income. From there, you will divide your fixed costs by the number of complete annual exams, or annual patient visits, to get your chair cost.

OALS

OALS