A New Year – a time to make resolutions, be optimistic, and crash! We all start the year with great intentions, but before the end of January, most of us have fallen back to our old habits.

Moving Forward

In order to get anywhere, we have to keep moving forward, even when we have a few set backs. Moving forward gets us to where we want to go, it helps us grow, and it makes life fulfilling.

Setting Goals

As a Certified Financial Planner® I start my client’s journey by diving into what is truly important to them. To be a fiduciary, I must ensure that your goals guide our decisions (it’s not about telling you what to do based on sales targets, product pushes or my own income). Clarity is truly understanding you and is vital to ensuring your forward progress. Of course, that doesn’t mean we don’t redirect as new curves in the road present themselves.

Investment Policy Statement

An Investment Policy Statement (IPS) is developed to ensure that recommendations align, not only with your goals, but also with your investment confidence and experience levels, your ability to manage risk, and your anticipated timelines. An IPS is a guidepost that should also highlight your social and moral beliefs when it comes to the alignment of the products that build your portfolio.

Data Collection

Once we truly understand who you are and what is important to you, we need to have a clear picture of where you are today. I like to think of this as the “start of the year organization of all your important documents.”

What assets and liabilities do you have? What terms and rates are you carrying on your debts? What types of investment accounts do you have? What investment holdings are in your portfolio? How does your business integrate with your personal finances? Understanding where you are currently is the basis of creating Confidence to where you are going.

Taxation

Taxes are your greatest expense – not only today, but also in retirement. Taxes appear in your business, affect your income, and impact nearly every purchase you make. It’s essential that there is a clear understanding of how taxes work today and a realization that no one truly knows what taxation will be like in the future.

Buckets?

We often use the bucket analogy to illustrate how we save. Remember taxes? Different type of accounts are taxed differently (Should I Invest in a RRSP or a TFSA). And because we don’t know the future tax implications on our withdrawals, we want to ensure that we build in options (different buckets of money) to help manage our tax rates now and in retirement.

Investment Buckets for Taxation

The Canadian Tax system is complicated! (Marginal vs Average Tax Rate). We have RRSP accounts that we deposit pre-tax money into and pay tax when we withdraw. This is a great option to manage taxes today and help boast the benefits of compounding. Because it can create a tax problem in retirement, we want to balance our savings.

We contribution to a TFSA account with after-tax money, but all growth and withdrawals are tax free.

We purchase a home, which on sale, is currently eligible for the principal residence exemption, so any increase in the value of that asset is tax free.

Commercial and recreational real estate is subject to capital gains tax, the inclusion rate is currently 50% as taxable income.

Your professional corporation often qualifies for the Lifetime Capital Gains Exemption, which is expected to increase to $1,000,000 of tax free capital gain.

Then we have insurance products – for a brief on that, follow the link.

You get the idea – lots of buckets!

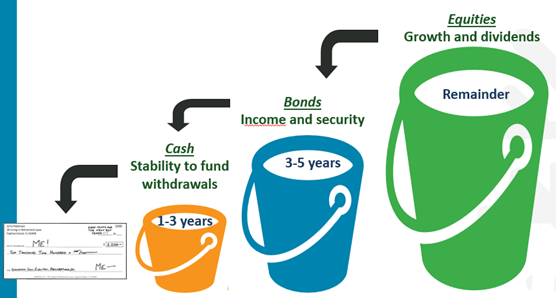

Buckets for Withdrawal?

And then we also have buckets based on asset allocation. Business ownership, including stocks, and fixed income, including bonds, are structured to help ensure that you don’t have to sell those critical businesses when market values are down AND you can maintain your lifestyle knowing that you have the cash and fixed income buckets to draw from while you wait for the markets to recover allowing your business bucket to overflow and refill the cash and security buckets.

Flexibility

Having different investment buckets from which you can draw from in retirement will be critical to allow you to live the life you dream of and help manage your future taxation. Understanding the sweet spot of where your taxes are today in balance for tomorrow (based on our current tax regime) will help you make smart financial decisions

Staying on Track

Just like with New Year Resolutions, falling off track is easy. It’s a lot easier to stay on program when you have a coach in your corner. Someone who understands you, your occupation, and the financial world will ultimately put you on the path to Controlling your buckets, your future, your dreams!

Advisory

As your Chief Financial Officer, I am here to help you set up all the buckets that will provide you with the flexibility you’ll need. Helping you understand your money and assisting you in making smart financial decisions about your debt repayment, insurance protection, tax management and wealth creation, are just some of the ways that I work as your fiduciary.

Have more questions than answers? Educating you is just one piece of being your personal CFO that we do. Call (780-261-3098) or email (Roxanne@C3wealthadvisors.ca) today to set up your next conversation with us.

Roxanne Arnal is a former Optometrist, Professional Corporation President, and practice owner. Today she is on a mission of Empowering You & Your Wealth with Clarity, Confidence & Control.

These articles are for information purposes only and are not a replacement for personal financial planning. Everyone’s circumstances and needs are different. Errors and Omissions exempt.

ROXANNE ARNAL,

Optometrist and Certified Financial Planner

Roxanne Arnal graduated from UW School of Optometry in 1995 and is a past-president of the Alberta Association of Optometrists (AAO) and the Canadian Association of Optometry Students (CAOS). She subsequently built a thriving optometric practice in rural Alberta.

Roxanne took the decision in 2012 to leave optometry and become a financial planning professional. She now focuses on providing services to Optometrists with a plan to parlay her unique expertise to help optometric practices and their families across the country meet their goals through astute financial planning and decision making.

Roxanne splits EWO podcast hosting duties with Dr. Glen Chiasson.