When the time comes to take the plunge and finally purchase a practice, there are so many thoughts that race through a buyer’s mind. Everyone is looking for the perfect practice. Unfortunately, it simply does not exist. A buyer can look at 10 different offices and find something wrong with every single one. It is understandable to want the best as this is a major purchase. However, buying a practice requires a delicate balance between logic and emotion.

While some would believe that emotion has no place in a decision this important, in reality, it does. Like it or not, emotion does in fact play a very important role when buying a business. It is critical that a purchaser cannot allow emotion to dictate the decisions that have to be based upon logic. And sometimes, the purchaser should not let logic overtake the decision-making process when emotion is required. The key to this delicate balancing act is knowing how to separate the two, and to recognize when either state may be impacting your decision-making process altogether.

Becoming a well-prepared and knowledgeable buyer is the key to your success. The initial choice to purchase is largely motivated by the desire to better your circumstances. A purchaser is likely tired of working for another doctor. Why build equity for someone else? Why have one’s schedule controlled by another? Why not invest in oneself? Most purchasers have likely reached the point where enough is enough – its time to be the boss. It is important to consider the potential rewards gained from owning your own practice. While everyone has their individual reasons, certainly controlling your own destiny, making more money, having the opportunity to improve your quality of life, and helping others, are just a few of the common reasons. These are all things that most people hope to achieve.

Choosing to buy during a pandemic is truly the time to keep the emotional side in check so that you stay motivated, especially in this economy. There are likely many people advising against the purchase of a clinic. But why would this not be the right time? Interest rates are at their lowest and quite frankly because there are some people who are either afraid or simply do not qualify, you may not be in a competitive situation. This means, you would not need to overpay on a practice that you might have pre-pandemic or certainly one year post pandemic. Fear is important as long as it does not cripple you from making a decision. To be successful, you need to cut a new path to gain success. By no means should you take ridiculous risks either. Ownership is not for everyone. But if you are not prepared to be a career associate, ask yourself if the people giving you negative feedback would still say no regardless of the economy. Trust your instincts. If your inner voice tells you that you are meant to be your own boss, then stop seeking the approval of others and look for guidance from those who are well-informed and knowledgeable.

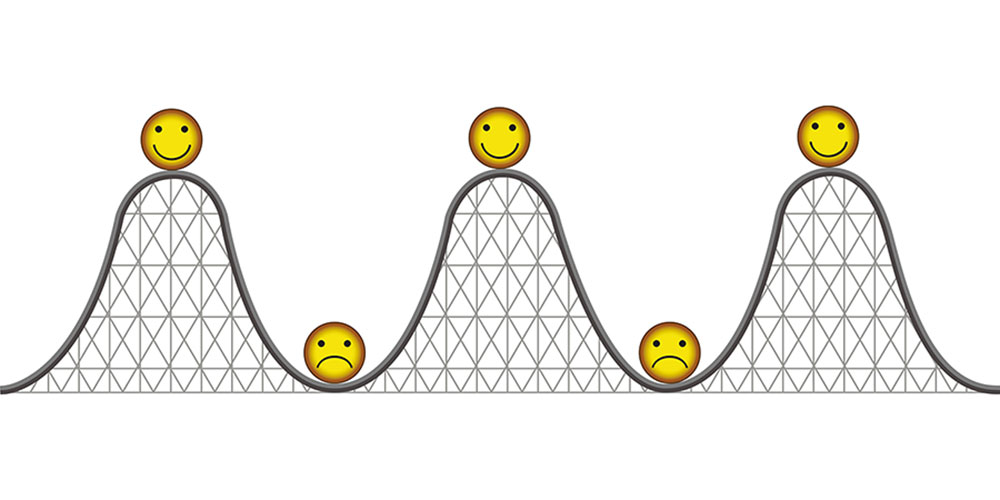

There are going to be times during the clinic-buying process that you will be knocked off track. You will face situations where deals fall through, you will find it hard to locate any decent practices for sale, or you uncover some issues during your due diligence. These scenarios, plus many others, can surface after you have invested a lot of time, effort, and yes money, to analyze the office. A buyer must, however, have the strength to dust off these little setbacks and carry on towards the finish line or make the decision to walk away. This is definitely where emotions can play havoc on a prospective buyer. On the one hand, you want to stay upbeat and committed to the goal. On the other hand, though, you also need a good dose of logic because you must decide if you can live with some negatives or simply not move forward because it is the wrong deal.

Finally, you may be the best clinician. But you still need to educate yourself and surround yourself with experts. A good accountant, lawyer, and banker are so key to the equation. The right team behind you enables you to further grow the practice you acquire.

Last piece of advice. Please do not think you are an appraiser. Even if you have seen lots of practices, you are still not an expert. For every practice a buyer reviews, guaranteed an appraiser has seen twenty. A qualified appraiser has placed a value on an office based on a variety of factors. You might not agree with the value. That is fine but telling the appraiser they have overvalued the office is simply wrong. If you like the office but do not agree with the value, nothing stops you from making an offer at a price you are comfortable with. It really can be that simple. If your offer is accepted, due diligence will give you the true opportunity to see if the practice really is a good investment. Always remember, the stress you experience as a buyer is very similar to what a vendor also experiences. These are significant transactions and should not be taken lightly.

JACKIE JOACHIM

Jackie has 30 years of experience in the industry as a former banker and now the Chief Operating Officer of ROI Corporation. Please contact her at Jackie.joachim@roicorp.com or 1-844-764-2020.