The current geopolitical landscape, marked by conflicts and economic uncertainties, has led to increased stock market volatility amid an ongoing news cycle creating fear. So what can you do?

What is Stock Market Volatility?

Stock market volatility refers to the frequency and intensity of price movements in the market. It is often measured by indices such as the S&P 500 and the TSX, which track the performance of the top US and Canadian stock markets, respectively. Volatility can be driven by various factors, including geopolitical events, economic data, and investor sentiment.

Market price represents what someone will pay at that given moment for the stocks on the listed market. Because people can be fickle, it’s become increasingly critical to manage your overall investment portfolio to help insulate you from “the great swing” or the next market impacted tweet.

Why are people so fickle right now?

Markets like predictability. Just like a full exam schedule, we get comfort in knowing our next available opening is two weeks out.

Geopolitical events, including conflicts and trade tensions, create significant uncertainty and dramatic fluctuations in global financial markets, requiring Canadian investors to manage these risks effectively.

Strategies for Managing Volatility:

- Diversification

A diversified portfolio spreads investments across various asset classes, sectors, and geographic regions.

Diversification reduces reliance on any single investment and helps mitigate the impact of market volatility.

For example, combining stocks, bonds, and alternative investments can provide a balanced approach.

2. Risk Assessment

Understanding your risk tolerance is crucial.

Investors should assess their comfort level with market fluctuations and adjust their portfolios accordingly. Everyone likes to finish with the greatest growth, but how you manage down markets, both in the magnitude of the dip and the length the dip lasts, will have a greater overall impact on your earnings than the markets themselves.

Know thyself and ensure your portfolio is aligned appropriately.

3. Long-Term Focus

It’s critical to avoid panic selling during market downturns.

Maintaining a long-term perspective can help investors ride out short-term volatility and benefit from potential market recoveries.

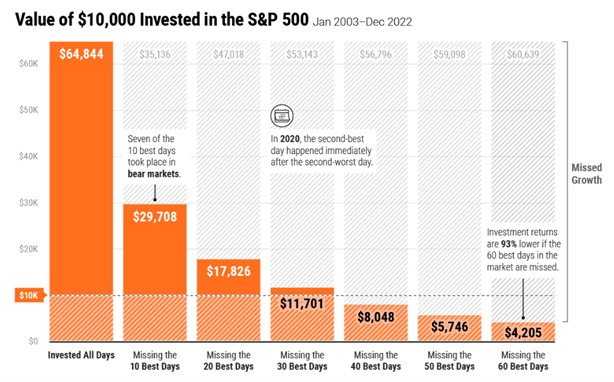

Missing out the best market days has an astounding impact on your overall return. Staying focused on long-term goals rather than reacting to daily market movements is key.

4. Regular Portfolio Review

Periodically reviewing and rebalancing your portfolio ensures it remains aligned with your investment goals and risk tolerance.

This can involve adjusting asset allocations or adding new investments to enhance diversification.

Don’t forget that market downturns can be a great opportunity to purchase more of a good business at a discounted price.

Conclusion

Managing stock market volatility requires a strategic approach that includes not only how your portfolio is structured, but also your response to the volatility.

By implementing the above strategies, you can navigate the complexities of today’s financial environment with greater confidence and security.

Being proactive, rather than reactive, is your best defense.

Unsure if you have a solid portfolio to weather the storm? We offer a no obligation second opinion services. Reach out to via email at roxanne@c3wealthadvisors.ca or call 780-806-3097 to arrange your second opinion.

Roxanne Arnal is a Certified Financial Planner®, former Optometrist, Professional Corporation President, and practice owner. Today she is on a mission to Empower You & Your Wealth with Clarity, Confidence & Control.

These articles are for information purposes only and are not a replacement for personal financial and tax planning. Individual circumstances and needs vary. Tax strategies should also be discussed with your tax accountant and lawyer. Errors and Omissions exempt.

ROXANNE ARNAL,

Optometrist and Certified Financial Planner

Roxanne Arnal graduated from UW School of Optometry in 1995 and is a past-president of the Alberta Association of Optometrists (AAO) and the Canadian Association of Optometry Students (CAOS). She subsequently built a thriving optometric practice in rural Alberta.

Roxanne took the decision in 2012 to leave optometry and become a financial planning professional. She now focuses on providing services to Optometrists with a plan to parlay her unique expertise to help optometric practices and their families across the country meet their goals through astute financial planning and decision making.

Roxanne splits EWO podcast hosting duties with Dr. Glen Chiasson.