“Show me the money!” is a famous line from the movie Jerry Maguire. We’ve also heard it from our clients. How much should I expect to be in my bank account each month? How much should I spend on new equipment? And even, where did the money go?

Ultimately, the answer to all of these questions is found in the practice’s budget. The budget is a roadmap for how to manage the practice’s finances. Many practices, however, don’t have a budget. The best way to create a budget is to follow an idealized P&L and actively manage it to achieve financial success.

All this takes time and dedication. However, if you want to see success in your optometric practice, it means not just working in the business, but on the business as well.

Keep in mind too that the budget of the practice must support the strategy the business has chosen to adopt. For instance, equipment costs may be a higher percentage of gross for a practice that has decided to specialize in Dry Eye and is investing in new equipment to support that revenue stream.

Below are the Key Parts of a P&L and some considerations for each category.

REVENUE

The top line of the P&L is Revenue or Gross Revenue. This is all the money coming in from all sources; professional fees, spectacle lenses, frames, contact lenses, therapeutics and other items. How much you are projecting to grow this line is directly related to the Goals you have set out for the year. There are many things that can impact Revenue; if you are introducing a new service, bringing on a new associate, or investing in marketing, among others.

EXPENSES

Cost of Goods Sold (25% of gross revenue)

The next line to analyze is Cost of Goods Sold. The highest expense category, it is difficult to get it below 25%. A practice that has more than 12% of gross revenue coming from contact lenses will have an especially tough time due to the low margins in contact lens sales. Buying Groups, and more recently, Buying Alliances, are a great way to reduce product costs since they are able to offer volume discounts to their members. As a general rule for primary practice, 35% of the COGs is spent on frames and sunglasses, 40% on lenses, 20% on contact lenses and 5% is on therapeutics. Running a specialty practice will have a slightly different COGs breakdown depending on the focus. Product cost is the expense that you have the most control over. Provide this budget to your buyers and insist that they stick to it.

Staff Costs (19% of gross revenue)

Staff cost is normally the second largest expense category. This category should not only include wages but also paid holidays and staff retention strategies, which could include continuing education opportunities and staff bonuses. There is a real cost to recruiting and re-training. It is beneficial to invest a little more in nurturing your current staff to ensure a positive work environment to avoid having staff turnover.

Operating Costs (8% of gross revenue)

This category includes everything needed to run the practice but is not directly associated with sales. From telephones and computers to office supplies, the prices for these items should be researched and optimized. Ideally, we would like to see this number around 8%.

Overhead (6% of gross revenue)

Rent, utilities, building insurance, maintenance and cleaning are all part of this category. Obviously rents fluctuate depending on location. Our recommendation is that you allocate more for this category if it means you will have retail visibility and accessibility in terms of parking. As a general rule, this number should represent approximately 6% of gross revenue.

Marketing (5% of gross revenue)

Traditionally, optometrists have not spent a lot in this category. At one time, minimal ads in the Yellow Pages and the local newspaper were all that were necessary or allowed. Increased competition, particularly in the form of the internet, has necessitated a change in thinking.

Equipment (2% of gross revenue)

Testing and exam lane equipment is a fundamental necessity to the clinic, and so gets its own category. As well as needing to maintain the diagnostic equipment and paying for the lease, owners need to account for the depreciation of the equipment and the eventual necessity to replace and update all equipment. 2% of revenue should go towards keeping your equipment current and relevant.

PRACTICE NET (35% of gross revenue)

Once all of the expenses have been paid, the Practice Net is what remains. The associate(s) and the owner are paid from this balance.

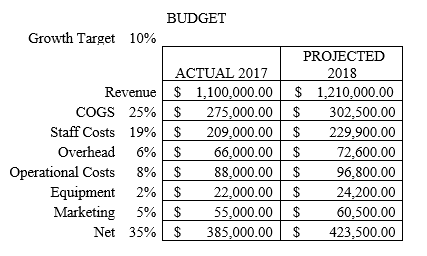

With a goal of increasing productivity by 10%, this is how a practice budget might look:

By laying out a budget, and managing it diligently, you will be able to anticipate how much money you can expect to earn this year by making great decisions that adhere to your budget.

By laying out a budget, and managing it diligently, you will be able to anticipate how much money you can expect to earn this year by making great decisions that adhere to your budget.

KELLY HRYCUSKO

is the co-founder and managing partner of Simple Innovative Management Ideas (SIMI) Inc. and expert Practice Management contributor for Optik magazine. She can be reached at info@simiinc.com.